Despite the fact that the majority of Singaporeans are familiar with the process of buying a HDB flat or condominium, only a small percentage of us have actually bought real property here. Only 5% of Singaporean households live in landed properties, nevertheless.

Here is another guide to all the necessary expenses of having a landed property in Singapore, if you’ve succeeded in accumulating sufficient funds to explore purchasing a landed property or are only here out of interest to check if your bank balance is thick enough for a property improvement.

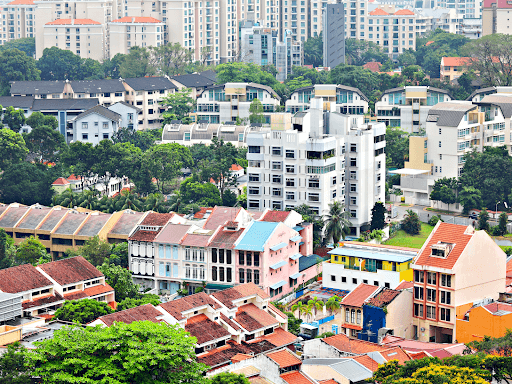

Source: Sevens Group

Types of landed houses in Singapore

Before we get straight into the nitty gritty calculations, let’s see if you are aware of the types of landed homes available in Singapore.

In Singapore, there are four basic categories of landed property: Good Class Bungalows (GCB), Bungalows, Semi-Detached and Terrace houses. You can read more about them at our previous blog article here.

What do the maintenance fees for landed property look like?

-

Monthly Mortgage

With a maximum Loan-To-Value (LTV) of 75% and an average loan term of 25 years, you may only obtain a private house loan from a bank or other financial institution once you buy a private property.

In terms of interest rates, they differ based on fixed or floating packages. The rates offered by each bank may vary as well (often 1.2% to 3%). Depending on the lender’s lock-in duration, fixed interest rates are established for a length of time between two and five years. Regarding variable rates, they may fluctuate based on market values.

We advise obtaining a loan without a lock-in term if the home you intend to purchase is still being built, generally known as a building under construction (BUC), so you will be able to revalue to a smaller sum in the future. In terms of finished homes, you might wish to obtain a loan with a lock-in term to guarantee that the interest rates are kept and enable you to budget your money every month. However, we would still recommend you to speak to a professional mortgage advisor, don’t count on us.

-

Home Insurance

The significance of home insurance is never felt until something, for example, a fire, happens.Even though we live in a country with minimal levels of crime, and are geographically protected from natural disasters,you (and certainly your wallet) will regret not getting your home covered should anything happen.

Still, most homeowners would want to obtain home insurance to make sure that their house and possessions are protected in the event of a disaster or theft, even if in some circumstances (after you have paid off your mortgage in whole), you are not legally required to have your property protected.

-

Utility Bills

Even though you may take a deep breath of relief realizing that owning a landed property won’t include paying the extravagant monthly maintenance fees as condos require, you’ll still need to think about your home’s regular utility costs.

If you’re one of those people who pays attention to your power and water bills, you could be able to maintain your payment under S$250. In contrast, if using the air conditioner daily is necessary, you may spend up to S$600 each month.

-

Property Tax

Property taxes is everybody’s worst fear, I see. You can guarantee your property taxes will cost you an exorbitant amount of money because you have such a huge property. Calculate the Annual Value (AV) of your home by the applicable tax rate to get the fees you’ll be obligated to pay. We’ve constructed a table below for easier viewing:

|

Annual Value (AV) |

Tax Rate | Property Tax Payable |

|

First S$8,000 Next S$4,700 |

0% 4% |

S$0 S$1,880 |

|

First S$55,000 Next S$15,000 |

– 6% |

S$1,880 S$900 |

|

First S$70,000 Next S$15,000 |

– 8% |

S$2,780 S$1,200 |

|

First S$85,000 Next S$15,000 |

– 10% |

S$3,980 S$1,500 |

|

First S$100,000 Next S$15,000 |

– 12% |

S$5,480 S$1,800 |

|

First S$115,000 Next S$15,000 |

– 14% |

S$7,280 S$2,100 |

|

First S$130,000 Above S$130,000 |

– 16% |

S$9,380 |

Source: IRAS

-

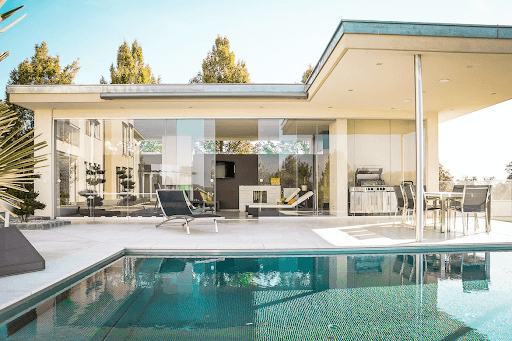

Swimming Pool

Having a home with a pool (apart from the glam when you flaunt to your guests) does significantly add prestige and value to your property. However, it comes with costs and proper, frequent maintenance which may not be for every homeowner. Homeowners should be prepared to set aside $300 – $400 per month (approximately $60 – $100 per week for each servicing) to ensure they have a functional pool with clean and crystal clear waters.

-

Lift

Having a lift in your own home does improve the quality of life, especially for your beloved elderly folks living together. Imagine having to climb 3 to 5 storeys up or down if you’ve forgotten to take something. With that being said, having this luxury does come with a price.All residential lifts are required to be properly serviced once every month, the costs of which may hover around $200 – $250. In addition, all residential lifts come with its respective Permit To Operate (PTO) which has a validity period of 1 year and has to be renewed on a year-to-year basis without a load examination. The cost for this varies around $400 – $600. Lastly, all lifts will have to undergo a full load examination where the lift is loaded to its maximum capacity to ensure it is still able to carry the intended weight. The cost of a full load examination varies around $800 – $1,000.

Discover Luxury Homes Built By An Award-Winning Developer

Sevens Group is a leading real estate development company with a proven track record of more than 10 years in the industry with over 100 landed developments completed to date. Sevens Group is consistently committed and passionate to developing superior quality standard, modern, and state-of-the-art real estate projects.

Looking for your dream home? Contact our Developer Sales Team today and they will be happy to be of service. In the meantime, keep your eyes peeled for our next article.